As a flight attendant, you play a crucial role in ensuring the safety and comfort of passengers during their journeys. Still, like many people, you might face fears and uncertainties when it comes to managing your personal finances. This blog post aims to equip you with the knowledge and tools needed to overcome those financial fears and take control of your money. By following these steps, you can gain confidence in managing your finances and achieve your long-term financial goals.

Educate Yourself: Knowledge is Power

The first step towards conquering financial fears is to educate yourself about basic financial concepts. Personal finance can seem daunting, but there are numerous online resources, books, podcasts, and courses available that can help you understand and navigate the world of finance. Start by familiarizing yourself with key terms such as budgeting, saving, investing, and retirement planning. By building your financial knowledge, you can make informed decisions and take control of your financial future.

Set Clear Financial Goals

A financial goal is a specific objective set to guide your money management efforts. Establishing clear financial goals gives you something to strive for and helps you focus your efforts. Define both short-term and long-term goals. Short-term goals might include building an emergency fund, paying off high-interest debts, or saving for a trip, while long-term goals could involve saving for college, retirement or buying a home.

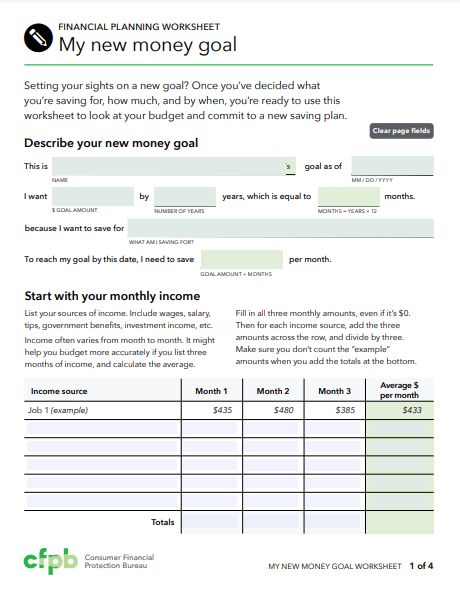

This financial planning worksheet from The Consumer Financial Protection Bureau is a very helpful resource to start planning your financial goals.

Crafting a list of financial goals is pivotal for effective budgeting. Clarity about your aims simplifies the journey towards them. Remember, your goals must be specific, measurable, and time-bound for optimal results.

Create a Budget

A budget is a powerful tool that aligns your income, expenses, and financial goals. Start by tracking your spending to understand where your money is going. Then, allocate your income towards essential expenses, savings, and discretionary spending. By creating a budget, you take control of your finances and gain a clear picture of your financial situation. It also helps you identify areas where you can cut back on spending and allocate more towards your goals.

Start Small and Take Action

Overcoming fear often requires taking small steps forward. Begin by tackling one aspect of your finances at a time. For example, start by saving a small percentage of your income or paying off a small debt. Taking action, even in small ways, builds confidence and momentum. As you see progress, you will become more motivated to continue making positive changes to your financial habits.

Seek Professional Guidance

If you feel overwhelmed or unsure about your financial situation, consider seeking guidance from a financial planner or advisor. These professionals can help you create a personalized financial plan, provide advice, and address your specific concerns. They can analyze your financial situation objectively and offer tailored solutions to help you achieve your goals. Having a professional by your side can provide reassurance and guidance, helping you feel more secure about your financial decisions.

Focus on Positivity and Progress

Instead of dwelling on past financial mistakes or negative experiences, focus on what you can do now to improve your situation. Celebrate small victories and progress along the way. By adopting a positive mindset and acknowledging your achievements, you can build confidence and reduce fear. Remember, everyone faces financial challenges at some point, and what matters is how you respond and grow from those experiences.

Embrace Continuous Learning

Personal finance is a lifelong learning journey. Stay curious and keep educating yourself about new financial strategies, investment opportunities, and ways to improve your financial well-being. The more you know, the more confident and empowered you will feel. Keep an eye on reputable financial news sources and participate in workshops or webinars to expand your knowledge continuously.

Financial Education Resources

- Budgeting Tools and Worksheets: The Consumer Financial Protection Bureau (CFPB) provides interactive budgeting tools and worksheets to help you manage your finances effectively. These tools can assist you in creating a budget, tracking your expenses, and setting financial goals.

- Financial Well-Being Toolkit: The CFPB’s Financial Well-Being Toolkit offers practical resources and guides to help you assess and improve your financial well-being. It covers topics such as setting goals, managing day-to-day finances, dealing with debt, and planning for the future.

Feel free to explore these resources to gain valuable insights and tools for managing your finances effectively and improving your financial well-being.

Overcoming financial fears is a process that takes time and practice. Flight attendants, like anyone else, can gradually conquer their fears by educating themselves about personal finance, setting clear goals, creating a budget, taking small actions, seeking professional guidance when needed, focusing on positivity and progress, and embracing continuous learning. By implementing these steps, flight attendants can gain confidence in managing their money effectively and achieve financial success. Remember, you have the power to take control of your finances and shape a prosperous future for yourself. So, embark on this journey with determination and watch yourself soar to financial freedom.

Leave a comment